Yesterday, Tammy Baldwin’s increasingly probably GOP rival made a surprise appearance at a campaign event in Madison. Vukmir attempted a gotcha question during the Q/A and asked Sen. Baldwin why she voted against the Trump tax bill and opposed tax cuts for the people of Wisconsin.

“I don’t begrudge anybody the return they’re going to get,” Baldwin said of the increased tax return dollars many will see this year. “I just wish it were permanent. I wish it weren’t so skewed.”

Economic policy has quickly entered center stage in the messaging war. Senator Baldwin has been focused on defending the middle class her entire career, and yesterday doubled down with a bold ad about the so-called #GOPTaxScam. The piece attacks Wal Mart, Wells Fargo, Harley Davidson, and others for firing thousands of workers while allowing millions in corporate share buy backs, while anticipating record corporate tax cuts instead of reinvesting in the companies and community.

Following the brief but tense exchange, The host organization tweeted that the “back and forth between @LeahVukmir and @tammybaldwin could be a preview of general election debate to come,” and Vukmir replied, “Can’t wait.”

Tammy Baldwin is working to spread her message to battleground regions of the state, including Wisconsin’s Fox Valley. Kimberly-Clark, the maker of Huggies and Kleenex, plans to close two facilities in Fox Valley despite the fact that Wisconsin workers helped create $3.3 billion in operating profit last year. From an electoral vantage point, the Fox Valley leans Republican but varies between parties more than other parts of the state, making it one of Wisconsin’s key swing districts.

In a meeting with anxious K-C workers, Senator Baldwin compared their circumstances with Trump’s tax policies: “The decisions are very puzzling to me. I’ve heard $100 million in incentives. But Kimberly-Clark just got major tax benefits from the recently passed tax bill in Congress.”

The incentives are looming as late last night the Wisconsin Assembly voted 56-37 in favor of tax incentives that will cover 17 percent of wages and 15 percent of any facility upgrades. The Baldwin campaign argues that $3.3 billion in operating profit hardly warrants such unprecedented tax incentives, though Wisconsin’s electorate remains fiercely divided on the issue.

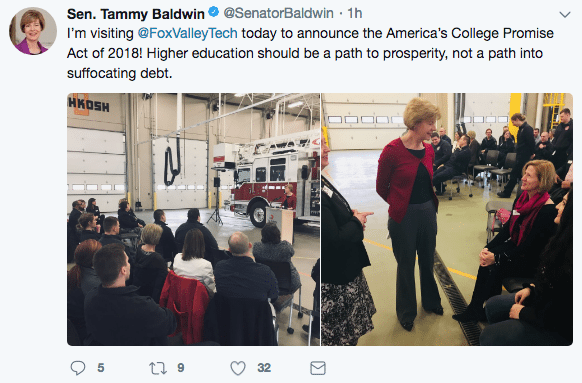

Still, Baldwin is determined let voters know Vukmir’s characterization of her as an “out of touch radical” is without merit. She recently re-introduced her “Buy America” legislation to rebuild America’s crumbling water infrastructure with American made steel. This afternoon, Sen. Baldwin is touring community colleges and apprenticeship programs in Fox Valley: